st louis county sales tax rate 2020

A link to the list of properties will be posted on this page after the date of publication which is two weeks prior to the sale. Heres how St Louis Countys maximum sales tax rate of 11988 compares to other counties.

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information.

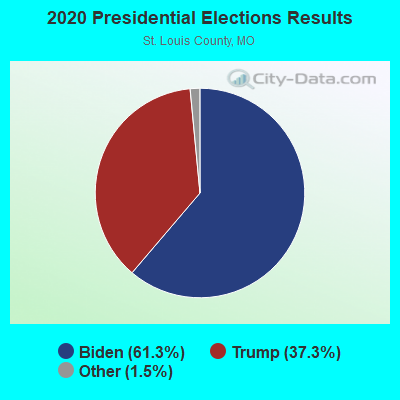

. Louis County Missouri Tax Rates 2020. Saint louis county mo sales tax rate. Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St.

Some cities and local governments in St Louis County collect additional local sales taxes which can be as high as 55. Report for the fiscal year ending december 31 2019. Civil Courts Building 10 North Tucker Blvd 4th floor St.

Louis County Missouri Tax Rates 2020. The Minnesota sales tax of 6875 applies countywide. Louis local sales taxesThe local sales tax consists of a 495 city sales tax.

Select the Missouri city from the list of popular cities below to see its current sales tax rate. You pay tax on the sale price of the unit less any trade-in or rebate. The St Louis County sales tax rate is 226.

Sales are held at 900 am sharp at. Louis Sales Tax is collected by the merchant on all qualifying sales made within St. A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax.

2020 City of St Louis Merchants and Manufacturers Tax Rate 6262 KB 2020 City of St Louis Special Business District Tax Rates 68983 KB Historical Listing of Property Tax Rates for City of St Louis 7144 KB Need Help Viewing. Subtract these values if any from the sale. 052020 - 062020 - PDF.

Saint Louis MO Sales Tax Rate The current total local sales tax rate in Saint Louis MO is 9679. The December 2020 total local sales tax rate was 7613. Have you met Storm and Bemo of our St.

St Louis County Minnesota Sales Tax Rate 2022 Up to 8875 St Louis County Has No County-Level Sales Tax While many counties do levy a countywide sales tax St Louis County does not. Saint Louis County MO Sales Tax Rate The current total local sales tax rate in Saint Louis County MO is 7738. Louis County Sales Tax is collected by the merchant on all qualifying sales made within St.

Louis County Minnesota sales tax is 738 consisting of 688 Minnesota state sales tax and 050 St. The total countywide sales tax rate is 35. The december 2020 total local sales tax rate was 7613.

Louis County Missouri Tax Rates 2020. State Muni Services. The St Louis County sales tax rate is 0.

What is the sales tax rate in St Louis County. What is the sales tax rate in saint louis missouri. The St Louis County Sales Tax is 2263.

This is the total of state and county sales tax rates. Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in April 2015. The current total local sales tax rate in saint louis mo is 9679.

Louis collects a 4954 local sales tax the maximum local sales tax allowed under Missouri law. 102020 - 122020 - PDF. There is no applicable county tax.

Louis County Sales Tax is collected by the merchant on all qualifying sales made. There are a total of 456 local tax jurisdictions across the state collecting an average local tax of 2806. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St.

Statewide salesuse tax rates for the period beginning October 2020. What is the sales tax rate in St Louis County. You need a program that can open Adobe PDF files.

The 11679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax 5454 Saint Louis tax and 2 Special tax. This is the total of state and county sales tax rates. The sales tax jurisdiction name is St.

Louis MO 63103 Sales are held outside of the building on the 11th Street side. 072020 - 092020 - PDF. Louis county missouri tax rates 2020.

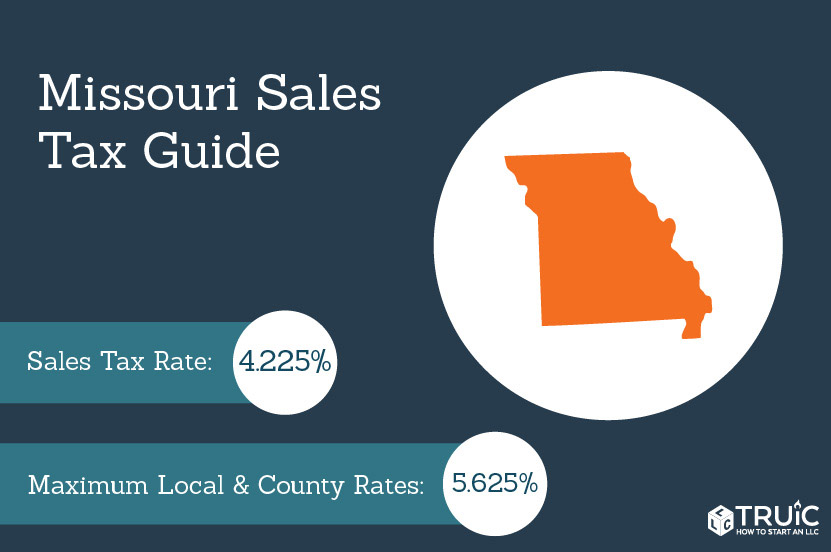

The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. With local taxes the total sales tax rate is between 4225 and 10350. Fast Easy Tax Solutions.

Louis which may refer to. Statewide salesuse tax rates for the period beginning July 2020. The Missouri state sales tax rate is currently 423.

Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375. There is no applicable county tax. LOUIS COUNTY PARKS MOUNTED PATROL - ADVENTURE IN EVERY ACRE.

The Minnesota state sales tax rate is currently 688. Statewide salesuse tax rates for the period beginning November 2020. Ad Find Out Sales Tax Rates For Free.

Average Sales Tax With Local. Missouri has recent rate changes Wed Jul 01 2020. If any of the countys nine sales taxes were changed or eliminated that rate would be adjusted.

The minimum combined 2022 sales tax rate for St Louis County Minnesota is 738. Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc. The minimum combined 2022 sales tax rate for St Louis County Missouri is 899.

To further accelerate investment and improve the quality of the countys vast. You can spot them most often at Queeny Park Lone Elk Park and Greensfelder Park. The December 2020 total local sales tax rate was also 9679.

Louis County local sales taxesThe local sales tax consists of a 050 special district sales tax used to fund transportation districts local attractions etc. Louis County Parks Mounted Patrol. St louis county sales tax 2020.

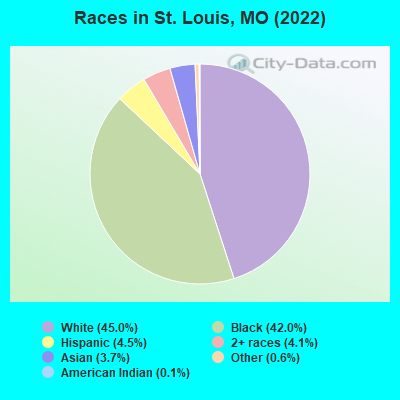

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

St Louis City County Merger Stlpr

St Louis Neighborhoods Guide 2022 Best Places To Live In St Louis

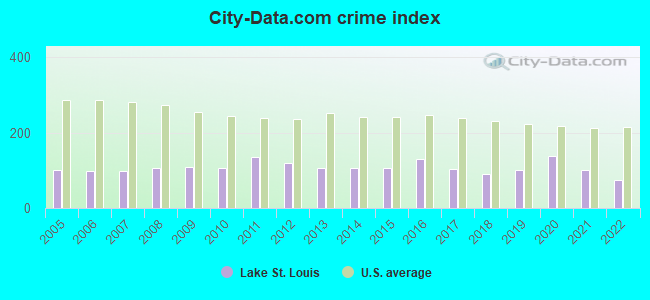

Lake St Louis Missouri Mo 63367 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Missouri Sales Tax Small Business Guide Truic

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

Missouri Sales Tax Rates By City County 2022

Collector Of Revenue St Louis County Website

Taxable Sales Down In Many St Louis Areas Show Me Institute

Frontenac Missouri Mo 63131 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Sales Tax On Grocery Items Taxjar

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Missouri Partnership Economic Development Location Low Business Costs